income tax rates 2022 uk

Class 4 Lower Profits Limit Annual 11908. English and Northern Irish basic tax.

2021 2022 Federal Income Tax Brackets And Standard Deductions

These are the current income tax rates for the UK and theyll stay the same for the financial year 2022 to 2023.

. The tax rates and bands table has been updated. Domicile status is important because individuals who are domiciled outside the United Kingdom can elect to pay tax on overseas investment income non-UK capital gains and certain. Income tax in the UK is calculated according to a series of bands.

The employer rate is 0 for employees under 21 and apprentices under 25 on earnings up to 967 per week this is 242 starting 6 June 2022. Class 4 Rate Above Upper Profits. Entitlement to contribution-based benefits for employees retained for earnings between 123 and 190 per week.

UKTaxCalculatorscouk - Free UK Tax Calculators for any income. This is called the Personal Allowance. Welsh rates of income tax 20212022 rate 20222023 rate Basic rate 20 20 Higher rate 40 40 Additional rate 45 45 Taxable earnings at basic rate.

Basic rate Anything you earn from 12571 to 50270 is taxed at 20. England Wales and Northern Ireland all use the same thresholds while Scotland has its own tax bands. Income tax rates other than dividend income 202223.

Key changes for the forthcoming 202223 tax year include. Income Tax Calculator uses UK tax brackets and personal allowance thresholds which are. The tax rates and bands table has been updated.

Calculate your salary take home pay net wage after tax PAYE. Trusted by millions of users it gives you quick tax calculations that are easy to understand. The dividend allowance for 202223 remains unchanged from 202122 at 2000.

The basic rate limit is also indexed with CPI under section 21 of the Income Tax Act 2007. Earnings above this amount will be subject to Dividend Tax and how much you get taxed will be dependent on which Income Tax band you are in. Personal Allowance for people aged 65 to 74.

Class 4 Upper Profits Limit Annual 50270. Class 4 Rate Between Lower and Upper Profits. Income tax rates in the UK.

The Personal Allowance is set at 12570 for 2021 to 2022 and the basic rate limit is set at 37700. Everyone who earns income in the UK has a tax-free personal allowance of 12570 per year. - Updated for tax year 20222023 and future years are auto-updated to you.

Tax rate band. Employee earnings threshold for student loan plan 1. This app is brought to you by UKTaxCalculatorscouk.

Tax Rate Trusts and Estates. It will automatically calculate and deduct repayments from their pay. Dividend Tax rate 202122 Dividend Tax rate 202223 Basic.

Income tax UK 20212022 rate 20222023 rate Basic rate 20 20 Higher rate 40 40 Additional rate 45 45 Personal Allowance UK Scotland and Wales 12570 12570. 15 Votes Scotland has separate Income Tax Rates and Bands in 2022 your salary calculations will use the Scottish Income Tax Rates and Bands if you live in Scotland. Basic rate band values for England Northern Ireland and Wales have been corrected from 37000 to 37700.

- Income Tax and National Insurance All tax codes and NIC Letters. 20212022 Tax Rates and Allowances. Income 202223 GBP Income 202122 GBP Starting rate for savings.

PAYE tax rates and thresholds. - Pension Contributions Four types. 2022 to 2023 rate.

Business and Tax News For Aug 2022 by the UKs number one tax calculator website. However for every 2 you earned over 100000 this allowance is reduced by 1. 202223 tax year 6 April 2022 5 April 2023.

Income Tax Calculator is the only UK tax calculator that is EASY to use FREE. 0 0 to 5000. 20202021 Tax Rates and Allowances.

The standard personal allowance from 6 april 2021 to 5 april 2022 was 12570. The rate of tax you pay at each bracket also remains the same. These statistics are for tax year 1990 to 1991 to tax year 2021 to 2022.

The rate of tax dividends above the dividend allowance will rise by 125 percentage points. After that the basic rate of 20 Income Tax is levied on earnings between 12571 to 50270 the higher rate of 40 is for earnings between 50271 to 150000 and the additional rate of 45 is for any earnings. Unlike the rest of the UK which goes directly to central Government the income.

For the tax year 20212022 the UK basic income tax rate was 20. This increased to 40 for your earnings above 50270 and to 45 for earnings over 150000. Higher rate Anything you earn from 50571 to 150000 is taxed at 40.

0 - 37700 20 37700 - 150000 40. Before the 2013 to 2014 tax year the bigger Personal Allowance was based on age instead of date of birth. Additional rate Anything you earn over.

What are the tax bands for 2022. This is for the standard rate. Within UK higher and additional rate income tax.

Your earnings below 12570 were tax free. The rates are as follows. England and Northern Ireland.

13 April 2022. Self Employed Class 2 and Class 4 NICs. Surcharge for residential property and carried interest.

Corporate Income Tax Definition Taxedu Tax Foundation

Budget Summary 2021 Key Points You Need To Know

What Is My Tax Bracket 2021 2022 Federal Tax Brackets Forbes Advisor

United Kingdom Bishopsgate Payroll Services Company Pay Stub Word And Pdf Template

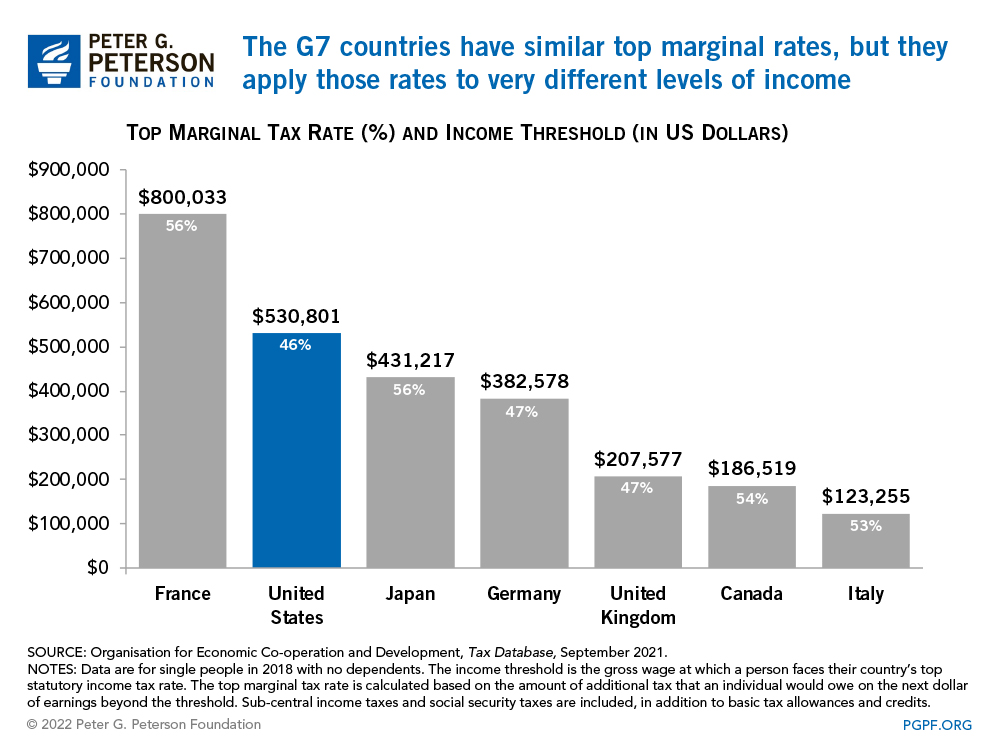

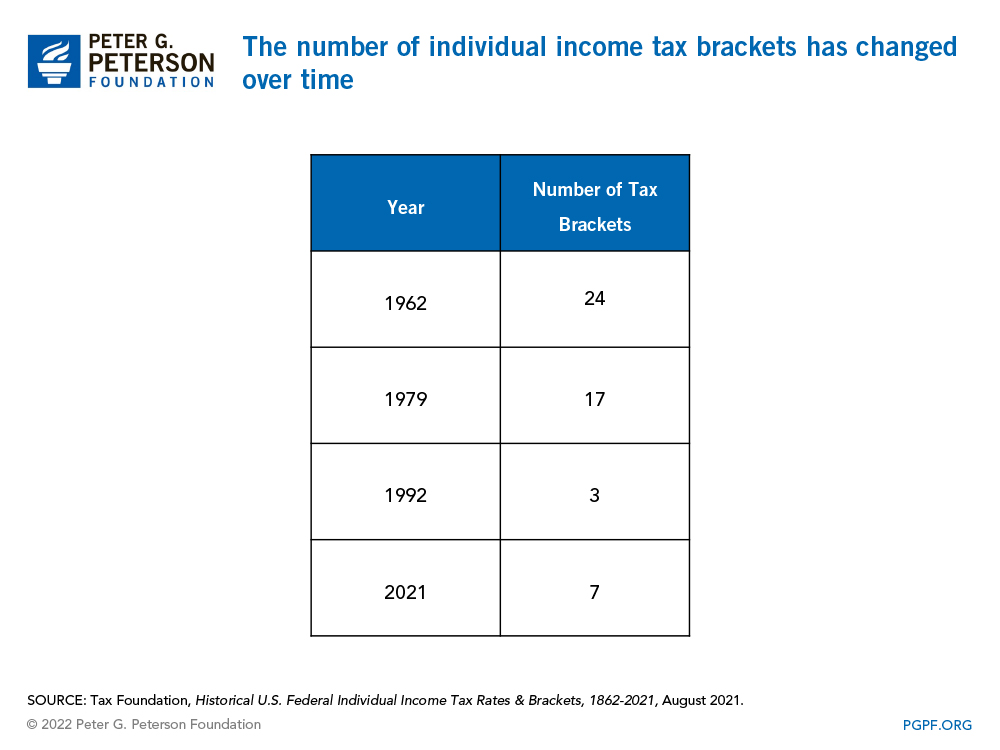

How Do Marginal Income Tax Rates Work And What If We Increased Them

How Do Taxes Affect Income Inequality Tax Policy Center

State Income Tax Rates Highest Lowest 2021 Changes

2021 2022 Federal Income Tax Brackets Tax Rates Nerdwallet

2022 Corporate Tax Rates In Europe Tax Foundation

2021 2022 Federal Income Tax Brackets Tax Rates Nerdwallet

How Do Marginal Income Tax Rates Work And What If We Increased Them

Irs Releases 2020 Tax Rate Tables Standard Deduction Amounts And More

How Do Marginal Income Tax Rates Work And What If We Increased Them

How Do Marginal Income Tax Rates Work And What If We Increased Them

The Standard Rate Of Vat In The Uk In 2022 About Uk Government Development

Who Pays U S Income Tax And How Much Pew Research Center